28+ How much mortgage can we get

But ultimately its down to the individual lender to decide. 36000 of gross income less fixed monthly expenses.

Here Are 22 Diagrams For Anyone Who S Obsessed With Dessert Chocolate Cookie Recipes Cookies Recipes Chocolate Chip Perfect Chocolate Chip Cookies

28000 of gross income or.

. This ratio says that. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. But our chase home affordability.

Fill in the entry fields and click on the View Report button to see a. 42000 of gross. For example if you make 10000 every month multiply 10000 by 028 to get.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Theyll also look at. Figure Out How Much Mortgage You Can Afford As a general rule lenders want your mortgage payment to be less than 28 of your current gross income.

As part of an. Ultimately your maximum mortgage eligibility. So to buy the average UK house costing 250000 youd normally need at least a 25000 deposit to borrow the 225000 required to buy the house.

Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. This mortgage calculator will show how much you can afford. A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly income on your.

The first step in buying a house is determining your budget. The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. To calculate how much house can I afford a good rule of thumb is using the 2836 rule which states that you shouldnt spend more than 28 of your gross monthly income on home-related.

While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643. Medium Credit the lesser of. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income.

Good Credit the lesser of. 36000 of gross income or. Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and no more than.

To determine how much you can afford using this rule multiply your monthly gross income by 28. What percentage of income do I need for a mortgage.

Illinois Appraisal Continuing Education License Renewal Mckissock Learning

Land Lord Rental Property Rental Property Management Free Property Rental Property

Sample Notice Of Default By Assignee To Obligor Free Fillable Pdf Forms Form Default Sample

31 Creative Blue Infographics Powerpoint Template On Behance Infographicsanimation Powerpoint Templates Business Infographic Powerpoint Design Templates

28 Coffee Station Ideas Built Into Your Kitchen Cabinets Decor Snob Kitchen Design Trends Kitchen Design Home Decor Kitchen

Shop Forest Fairy Crafts Enchanting Fairies At Artsy Sister Fairy Crafts Crafts Forest Fairy

28 Ways To Save Money Each Month Hanfincal Com

0 Old Highway 50a Tract 6 Columbia Tn 38401 13 Photos Mls 2429716 Movoto

Loan Servicing How Does Loan Servicing Work With Example

2

Total Debt Service Ratio Explanation And Examples With Excel Template

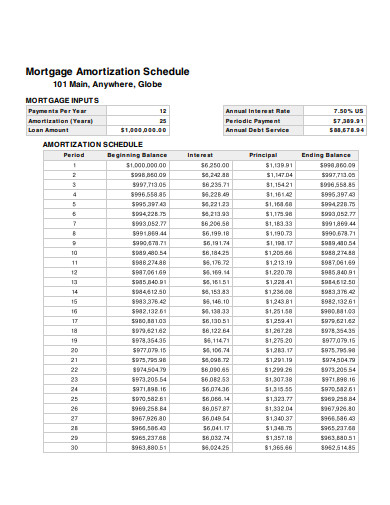

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

Total Debt Service Ratio Explanation And Examples With Excel Template

Second Story Addition Home Addition Plans Floor Plans Ranch Floor Plans

27 Green Business Plan Powerpoint Template Powerpoint Templates Presentation Powerpoint Design Templates Powerpoint Templates Business Powerpoint Templates

Sample Letter Of Explanation For Mortgage Refinance Luxury Cash Out Letter Template Konusu Lettering Letter Templates Business Letter Template

Break Free From Your Mortgage The Secret Banking Strategy To Help You Pay Off Your Mortgage Fast By Sam Kwak David Bruce Paperback Barnes Noble