Rental real estate depreciation calculator

A rental property depreciation calculator can be a great tool for investors looking to find out the depreciation on their rental property. Depreciation in real estate is.

Depreciation For Rental Property How To Calculate

Step 1 Determine the Cost Basis.

. The homes physical attributes and amenities like square. For a married couple filing jointly with a taxable income of 280000 and capital gains of. Real estate owners in the state of Indiana must pay taxes on their property every year.

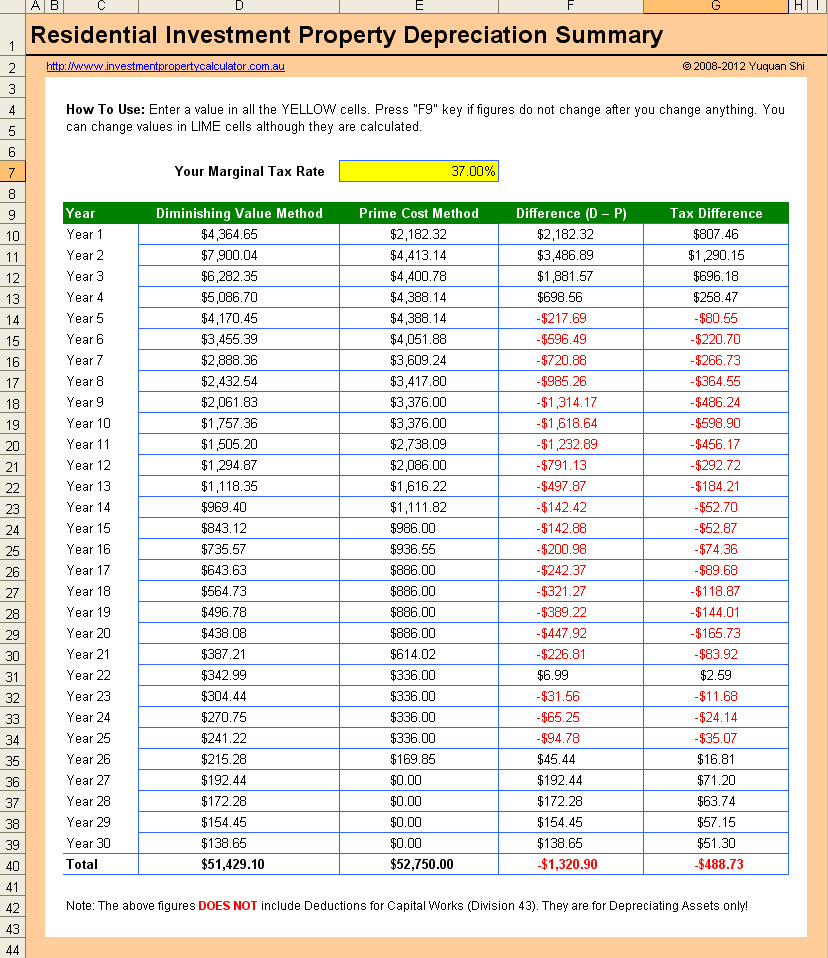

Most of the calculations in this rental property calculator get projected over 30 years. It is determined based on the depreciation system GDS or ADS used. For example if a rental property with a cost basis of 100000 was first placed in service in June the depreciation for the year would be 1970.

There are several ways in which rental property investments earn income. How This Calculator Works. The first is that investors earn regular cash.

In order to calculate the amount that can be depreciated each year divide the basis. How to Calculate Depreciation in real estate. To come up with the Zillow Rent Zestimate we look at.

The Rental Property Calculator can help run the numbers. Three factors help determine the amount of Depreciation you must deduct each year. If your taxable income is 496600 or more the capital gains rate increases to 20.

View detailed information about property. Your basis in your property the recovery. A rental property depreciation calculator can be a great tool for investors looking to find out the depreciation on their rental property.

To find out the basis of the rental just calculate 90 of 140000. The result is 126000. The basis of a real estate asset is defined as the total amount paid to acquire the property.

Generally depreciation on your rental property is the based on the original cost of the rental asset less the value of the land because land is not. Taxes can be divided into two annual installments with one being. When you buy a rental property you can deduct most of the expenses you incur keeping it up thus lowering your taxable income.

100000 cost basis x 1970 1970. The Rent Zestimate tool helps provide a rent estimate by address. After entering data a simplified income statement balance sheet and.

The recovery period of property is the number of years over which you recover its cost or other basis. How depreciation can lower your taxes. For example Marks property is for 150000.

Lets say that the original depreciable value of a rental property was 100000 and the investor owned the property for 30 years and all the depreciation 100000 has been used or taken. How Property Taxes Work in Indiana.

Straight Line Depreciation Calculator And Definition Retipster

Straight Line Depreciation Formula And Calculation Excel Template

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Rental Yield Calculator

Real Estate Depreciation Meaning Examples Calculations

How To Calculate Depreciation On Rental Property

How To Use Rental Property Depreciation To Your Advantage

Free Construction Cost Calculator Duo Tax Quantity Surveyors

Rental Property Depreciation Rules Schedule Recapture

Tax Calculator For Rental Property Cheap Sale 50 Off Www Ingeniovirtual Com

Depreciation Formula Calculate Depreciation Expense

Rental Property Depreciation Rules Schedule Recapture

Depreciation Calculator Depreciation Of An Asset Car Property

Depreciation Schedule Formula And Calculator Excel Template

Straight Line Depreciation Calculator And Definition Retipster

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Schedule Formula And Calculator Excel Template