Income tax calculation formula

Here we discuss the formula of personal disposable income along with step by step calculations. You can use the following Net Income Calculator.

Get Our Image Of Real Estate Investment Analysis Template Mortgage Comparison Investment Analysis Income Property

In the example shown the tax brackets and rates are for single filers in the United States for the 2019 tax year.

. You can use VLOOKUP to calculate income tax on a certain income in Excel. Corporate Tax Taxable Income Corporate Tax Rate. The table below shows the manual calculations for a taxable income of 50000.

Therefore the calculation of disposable income will be as follows. The IRS income tax withholding contains instructions on how much to withhold during a specific fiscal year. Employers use Form W-4 and the IRS income tax withholding tables to calculate withholding tax.

Businesses need various documents to properly calculate tax withholdings. There are two different methods to calculate tax withholdings. To calculate tax based in a progressive system where income is taxed across multiple brackets at different rates see this example.

Corporate Tax 45000 21 9450. Some Parts of salary are tax exempted such as phone bills Leave travel allowance. As taxable income increases income is taxed over more tax brackets.

Net Income Formula Calculator. The system is separate from the income tax system of Hong Kong and Macau which are administered independently. Where tax_table is the named range C5D8.

The income tax calculation for the Salaried. Find eligibility criteria to claim HRA Tax Exemption. You need to follow a bit lengthy calculation.

But on the contrary the new tax reform doesnt play its role in reducing the income inequality among different income earning groups of employees rather it shows 04 marginal. You have no added income so the gross income formula says you report 10000 as gross income. Income tax can be calculated using the VLOOKUP function of Excel but it is a bit lengthy and confusing.

This formula determines a single tax rate. She is in the bracket of 35 and the income tax on the same will be 96100 x 35 which is 33635. Kansas corporate income tax is calculated using the apportioned net income multiplied by the corporate income tax rate mentioned above.

Federal income tax rate. HRA Tax Exemptions - How to save income tax on House Rent Allowance if you are living in rented house. Taxable Income 50000 5000 45000.

In the second part of Schedule C you add up your total deductible business expenses. Corporations may opt to use a two-factor sales and property apportionment formula to calculate tax liability if the payroll factor for a taxable year exceeds 200 percent of the average of the property and. Income tax formula using VLOOKUP is not a simple formula.

The Individual Income Tax in China commonly abbreviated IIT is administered on a progressive tax system with tax rates from 3 percent to 45 percentAs of 2019 China taxes individuals who reside in the country for more than 183 days on worldwide earned income. The net income formula may not be reliable as it just does the calculation which may have a fraudulent report of profit which is generated by twisting rules of accounting. Thus XYZ Corporation is liable to pay 9450 as corporation tax.

In case any factor changes during the respective financial year the calculation can be done on a monthly basis. Taxable Income Adjusted Gross Income All Applicable Deductions. Taxable Income Formula Example 2.

Many taxpayers therefore pay several different rates. The result shows that the tax reform brings a 9 increases on a disposable income and 30 decreases on the income tax liability of employees under this investigation. Income From salary is the summation of Basic Salary House Rent Allowance Special Allowance Transport Allowance Other If any.

Guide to Disposable Income Formula. This false presentation of net income is done to pay less income tax.

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

Tax Calculation Spreadsheet Excel Formula Spreadsheet Spreadsheet Template

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

Tax Calculation Spreadsheet In 2022 Spreadsheet Template Spreadsheet Excel Formula

Tax Calculation Spreadsheet Worksheet Template How To Memorize Things Printable Worksheets

Calculation Of House Rent Allowance Allowance Kids Education Excel

Financial Projection Spreadsheet In 2022 Financial Analysis Financial Ratio Financial Statement Analysis

Total Comprehensive Income Astra Agro Lestari Tbk 2017 2018 Financial Statements Accounting Income Financial Statement Basic Concepts

Net Income Formula Calculation And Example Net Income Accounting Education Income

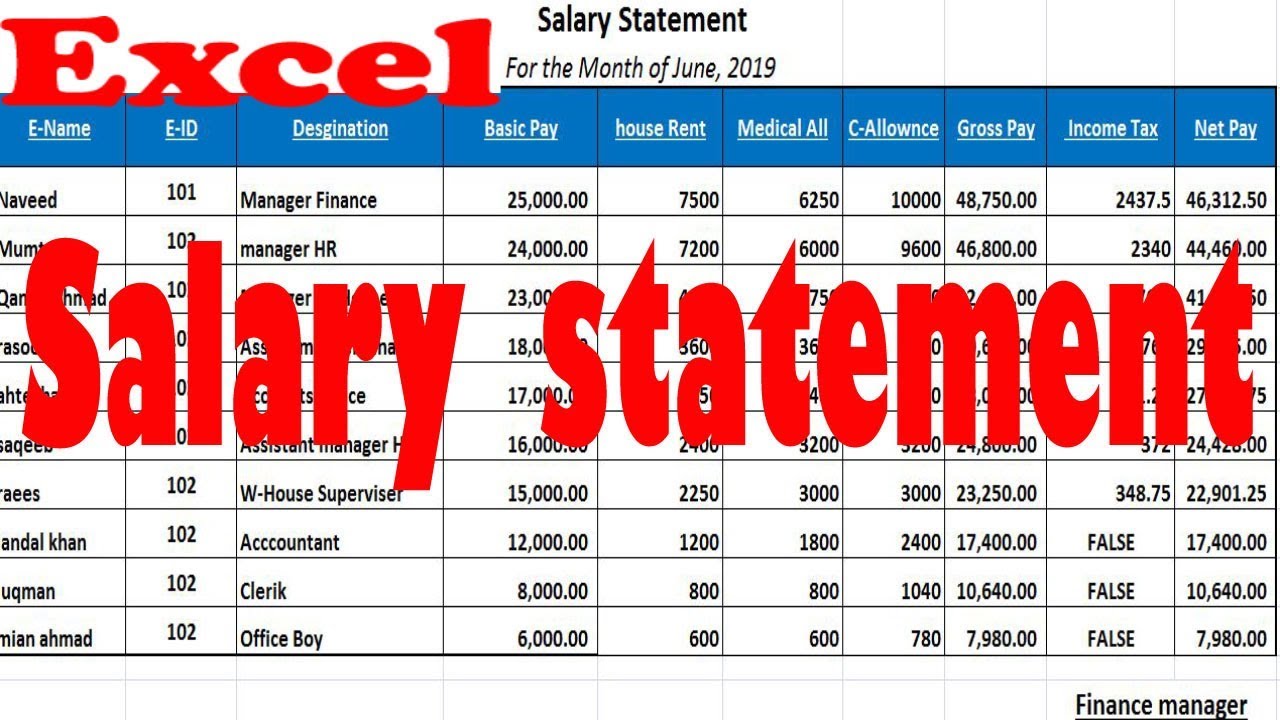

Excel Salary Sheet And Its Formula By Learning Center In Urdu Hindi Learning Centers Excel Free Learning

Pin On Storage

Ebit Meaning Importance And Calculation Bookkeeping Business Accounting Education Small Business Bookkeeping

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

How To Calculate Income Tax For Fy 2018 19 Edelweiss Wealth Management Youtube Income Tax Wealth Management Income

Income Tax Calculator Python Income Tax Income Tax

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula